Additional Column Tests Completed on Oxide Mineralization from Sewum and Boin

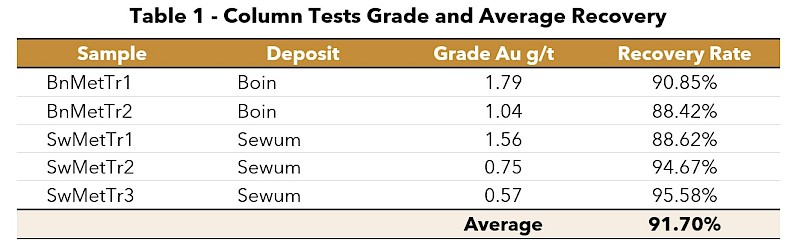

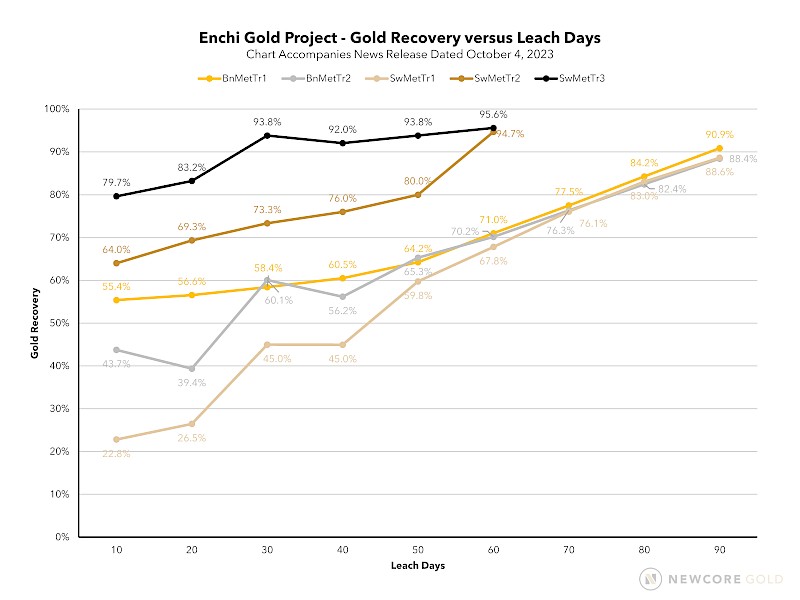

Vancouver, BC – Newcore Gold Ltd. ("Newcore" or the "Company") (TSX-V: NCAU, OTCQX: NCAUF) is pleased to announce positive results from five additional column tests completed as part of the ongoing metallurgical program at the Company’s 100%-owned Enchi Gold Project ("Enchi" or the "Project") in Ghana. An average gold recovery of 91.7% was achieved from column testwork completed on three composite samples from the Sewum Gold Deposit ("Sewum") and two composite sample from the Boin Gold Deposit ("Boin").

Highlights from Column Test Results

- Five Column Tests Completed, Average Gold Recovery of 91.7% Achieved.

- A total of five column tests (three from Sewum and two from Boin) returned an average gold recovery of 91.7%, with a recovery range of 88.4% to 95.6%.

- Testwork Further Advances the Understanding of Processing Options for Enchi.

- Testing completed on representative samples of oxide mineralization from trenches.

- Crush size in testing in-line with modelled crush size for heap leach processing.

- Larger sized samples used in the columns with each sample weighing 30 kg.

- Low Reagent Consumption.

- All samples showed modest cyanide consumption with an average of 1.2 kilograms per tonne ("kg/t"), with a 1.3 kg/t lime (hydrated) addition to maintain a pH above 10.5.

- Additional Metallurgical Testwork Underway.

- Optimization work continues on results from additional column tests to be completed on oxide mineralization from the Sewum, Boin, and Nyam gold deposits.

- A pilot heap bench-scale test is underway, to be completed in Q4 2023.

- Additional testing of sulphide mineralization from Sewum is in progress.

Greg Smith, VP Exploration of Newcore stated, "This additional set of column tests completed on representative oxide material from the Enchi Gold Project returned results that are consistent with prior results, returning high recoveries for all five composite samples. Metallurgical testwork completed on oxide mineralization confirms the generally modest lime and cement consumptions. This work continues to highlight the amenability of Enchi to heap leach gold recovery and the favorable results will be incorporated into our PEA update scheduled for H1 2024. This testwork was completed on samples from the two largest deposits currently identified on the Project, Sewum and Boin, which together compromise approximately 73% of the Mineral Resource Estimate. We continue to de-risk and advance the development of the Project with further metallurgical testwork underway on both oxide and sulphide mineralization at Enchi."

Metallurgical Testing Summary

A total of five composite samples, three from Sewum and two from Boin, were submitted for column testwork to the Intertek Lab located in Tarkwa, Ghana, approximately four hours by paved road from the Enchi Gold Project. Material for the metallurgical samples consisted of trench material collected for metallurgical sampling. The samples were selected to represent the two largest deposits on the Project, Sewum and Boin, and consisted of blended oxide material with individual samples and composites covering a range of gold grades.

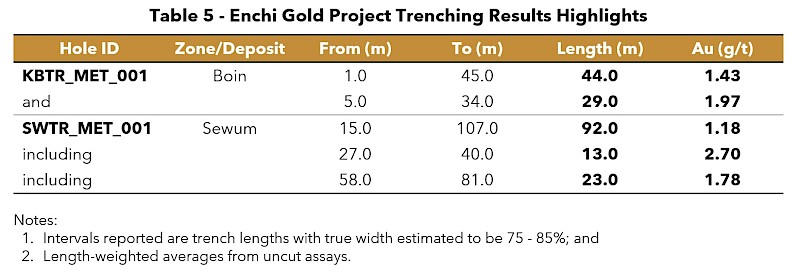

Composites BnMetTr1 and BnMetTr2 were prepared using 20 samples each from trench KBTR_MET_001 at Boin with a total weight of 60 kg per composite sample. Composite SwMetTr1, SwMetTr2, and SwMetTr3 were prepared using 20 samples each from trench SWTR_MET_001 at Sewum with a total weight of 60 kg per composite sample.

Recovery for the five samples averaged 91.7%, with a range of 88.4% to 95.6%.

Composite samples were homogenized by mixing all material from the individual samples and crushed to 70% passing 12.5 mm. Each composite sample was then split to provide sub-samples weighing 4 kg each. Two samples were removed and again split into a further four fractions of 2 kg for use in screening and grading analysis, head sample analysis, and ten-day coarse bottle roll leach tests.

Screening and Grading Analysis of Head Samples

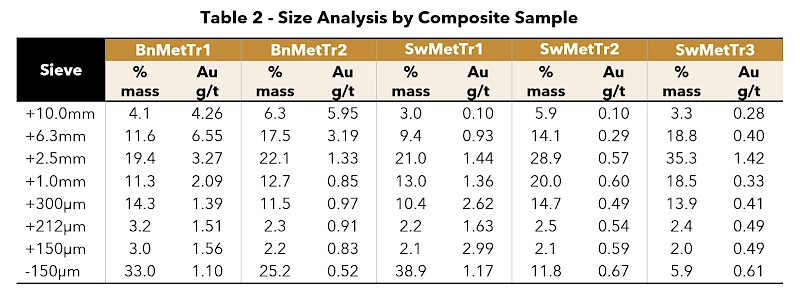

A size analysis was done on each of the five composite samples. The samples were tested at eight screen sizes and included analyses for percent mass.

The samples were assayed for gold which showed that gold was present in all size fractions analysed. The distribution shows relatively consistent gold grades for all size fractions within a range of 0.28 grams per tonne gold ("g/t Au") to 6.55 g/t Au, with two outliers grading 0.10 g/t Au. Results include 10% to 43% passing 300 microns indicating that agglomeration is warranted.

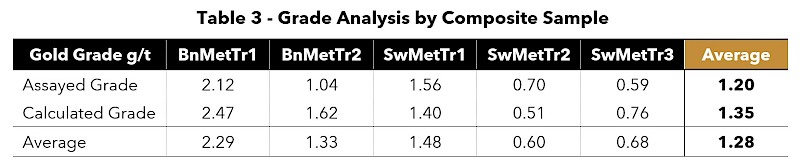

Head Sample Analysis

Using the results of the sizing and grading analysis, a head grade was calculated for each of the composite samples. The results were then compared to the head grade assays which were completed on the 50-gram subsamples. The results compared well for the five composites.

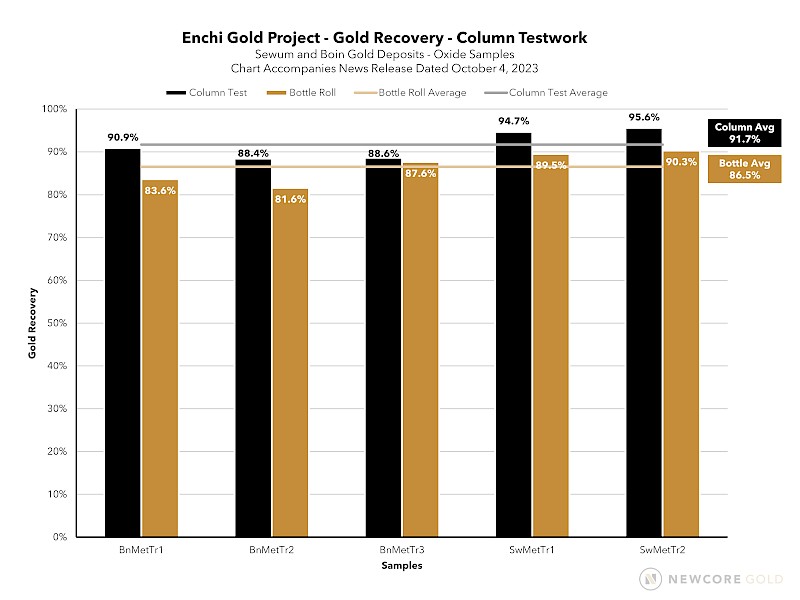

Ten Day Coarse Bottle Roll Leach

Simulated heap leach testing was conducted on the composite samples using two-kilogram sub-samples which underwent leaching for ten days. Batch dissolution tests (ten days, intermittent rolling-bottle) was completed under excess leach conditions (grind size - as received, 50% solids, leach time: ten days, pH 10.5, NaCN (sodium cyanide) addition 1 gram/litre). The final residue was dried, weighed, and assayed for gold. After each 24 hours of leaching, solution assays were taken and analyzed, and reagent consumption (cyanide and lime) was calculated.

For composite BnMetTr1, 66.4% of the gold was recovered on the first day, with recoveries increasing consistently to 83.6% on the tenth day. For composite BnMetTr2, 66.0% of the gold was recovered on the first day, with recoveries increasing consistently to 81.6% on the tenth day. For composite SwMetTr1, 74.6% of the gold was recovered on the first day, with recoveries increasing consistently to 87.6% on the tenth day. For composite SwMetTr2, 77.8% of the gold was recovered on the first day, completed testing at 89.5% on the tenth day. For composite SwMetTr3, 66.4% of the gold was recovered on the first day, with a final recovery of 90.3% on the tenth day. In all cases leaching continued after the first ten days with ultimate recoveries expected to continue to increase with additional leaching time.

A graph showing the gold recovery by sample can be viewed at the following link:

https://newcoregold.com/site/assets/files/5829/2023_10-ncau-nr-met-graph-columnvsbottle.pdf.

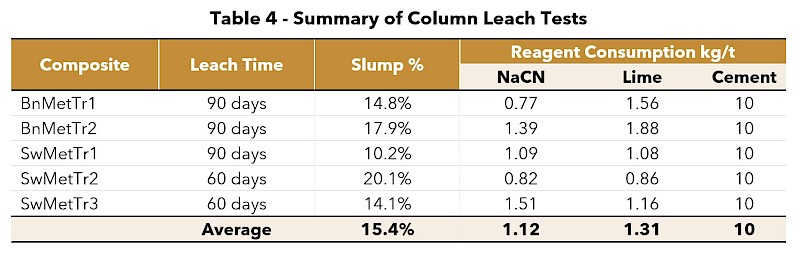

Metallurgical Testing - Column Tests

Five 30 kg closed-cycle column leach tests were conducted on the samples as received. The test charge was loaded into 150 mm in diameter by 1.5-metre-tall PVC columns. 30 kg of the individual samples were agglomerated in a rolling drum using Portland cement at a 10 kg/t addition rate and then allowed to air dry for three days. After the samples had been air dried, they were loaded into the columns with the columns tilted at an angle to avoid stacking before being set upright. The column was then allowed to sit for a day before the initial level was taken to determine the slump.

The leaching parameters used in these column leach tests included the addition of approximately 1.4 kg/t of lime which was blended into each feed solution, and a cyanide concentration of 1,000 ppm. The initial feed solution was prepared by adding lime to tap water to obtain a solution pH above 10.5, followed by the addition of one gram of sodium cyanide per litre of solution with a solution application rate of 10L/h/m2 for all samples. The column testwork was conducted under a closed cycle for 60-90 days. All solution samples were assayed for gold and pH and free sodium cyanide was analyzed and recorded. Leach residue was thoroughly washed, dried, screened and analyzed for gold by fire assay.

A graph showing the leach curve can be viewed at the following link:

https://newcoregold.com/site/assets/files/5829/2023_10-ncau-nr-met-graph-leach-chart.pdf.

The column tests are aimed at simulating the response to leaching of the sample with the emphasis on establishing the gold dissolution characteristics (rate and extent), reagent consumption, and the degree of slumping within the ore bed. All samples showed amenability to heap leaching, with recoveries averaging 91.7% after 60 to 90 days.

The samples showed low cyanide consumption averaging 1.1 kg/t with a 1.3 kg/t lime (hydrated) addition to maintain a pH above 10.5. The slumps were moderately above acceptable industry standards with an overall average of 15.4%. The sample response to a percolation rate of 10L/m2/hr resulted in some flooding. The ideal percolation rate will be studied and optimized.

The column leach test program has shown that the gold in the ore samples tested is readily leachable and amenable to heap leaching. The recoveries achieved are considered high and are interpreted to indicate strong amenability to heap leaching. The particle size distribution and size by size analysis performed on both the head and residue after leach showed that the maximum gold recovery occurred in the finer fractions as compared to the coarser size fractions.

Screening and Grading Analysis of Tails Samples

A size analysis was done on all the tails from the composite sample column tests. The samples were tested at eight screen sizes including analyses for percent mass and assayed for gold. The distribution shows consistently low grades of gold for all size fractions, in line with the high gold recoveries in the column tests, within a range of 0.00 g/t Au to 0.37 g/t Au with only five samples reporting greater 0.2 g/t Au. Four of the five samples with elevated results are related to the higher-grade sample which assayed 1.79 g/t Au.

Multi-Element Analyses

The five composites were tested for 33 elements using multi-acid digestion and analysed by Inductively Coupled Plasma Optical Emission Spectrometry ("ICP"). The five samples show very similar profiles for all elements analysed. All samples contain no silver with every result below the detection limit of 0.5 g/t silver. All samples reported low values for lead, zinc, and copper averaging 11, 21, and 10 ppm respectively and mildly elevated arsenic averaging 313 ppm with no relationship to the gold grade. Relative to previously analyzed sulphide material, the concentrations are much lower for the more mobile elements including calcium, magnesium, sodium, and sulphur, and consistently moderately lower for cobalt, manganese, nickel, and strontium.

Bond Work Index

The five composite samples were selected for bond index determination. Samples were sent from Intertek to Jet-Com Engineering in Tarkwa, Ghana and included a range of recoveries and gold grades. The five as-received samples were crushed to 100% passing 3.35mm and from this a 700 cm3 volume was measured and weighed to be used as feed for the bond mill. The grindability, defined as the ease at which a mineral particle is reduced to a predetermined size, of the samples ranged from 1.29 g/rev to 1.73 g/rev averaging 1.51 g/rev which shows that the ore requires relatively little energy to crush. The bond work indices range between 8.89 KWh/t and 10.60 KWh/t, averaging 9.58 KWh/t indicative of material defined as soft to low-medium hardness.

Boin and Sewum Oxide Sample Details

Two trenches were dug for metallurgical test work on the Enchi gold project. The locations of the trenches were selected in order to allow for wide gold mineralized intercepts in each of the two largest deposits, Sewum and Boin, currently identified on the Enchi Gold Project. Material exposed in the trenches is consider representative of the oxide portion for both deposits. A total of 61 m and 107 m was completed on KBTR_MET_001 from Boin and SWTR_MET_001 from Sewum respectively. Trench KBTR_MET_001 at Boin was dug-out manually while as SWTR_MET_001 was dug-out mechanically. Samples were assigned a new unique number and submitted to the Intertek Lab located in Tarkwa, Ghana.

Select assay results from the 5 holes of the drill program reported in this release are below:

Enchi Gold Project Mineral Resource Estimate

The Enchi Gold Project hosts an Indicated Mineral Resource of 41.7 million tonnes grading 0.55 g/t Au containing 743,500 ounces gold and an Inferred Mineral Resource of 46.6 million tonnes grading 0.65 g/t Au containing 972,000 ounces (see Newcore news release dated March 7, 2023). Mineral resource estimation practices are in accordance with CIM Estimation of Mineral Resource and Mineral Reserve Best Practice Guidelines (November 29, 2019) and follow CIM Definition Standards for Mineral Resources and Mineral Reserves (May 10, 2014), that are incorporated by reference into National Instrument 43-101 ("NI 43-101"). The Mineral Resource Estimate is from the technical report titled "Mineral Resource Estimate for the Enchi Gold Project" with an effective date of January 25, 2023, which was prepared for Newcore by Todd McCracken, P. Geo, of BBA E&C Inc. and Simon Meadows Smith, P. Geo, of SEMS Exploration Services Ltd. in accordance with NI 43-101 Standards of Disclosure for Mineral Projects, and is available under the Company’s profile on SEDAR at www.sedar.com. Todd McCracken and Simon Meadows Smith are independent qualified persons ("QP") as defined by NI 43-101.

Newcore Gold Best Practice

Newcore is committed to best practice standards for all exploration, sampling and drilling activities. Drilling was completed by an independent drilling firm using industry standard RC and Diamond Drill equipment. Analytical quality assurance and quality control procedures include the systematic insertion of blanks, standards and duplicates into the sample strings. Samples are placed in sealed bags and shipped directly to Intertek Labs located in Tarkwa, Ghana for 50 gram gold fire assay.

Qualified Person

Mr. Gregory Smith, P. Geo, Vice President of Exploration at Newcore, is a Qualified Person as defined by NI 43-101, and has reviewed and approved the technical data and information contained in this news release. Mr. Smith has verified the technical and scientific data disclosed herein and has conducted appropriate verification on the underlying data including confirmation of the drillhole data files against the original drillhole logs and assay certificates.

About Newcore Gold Ltd.

Newcore Gold is advancing its Enchi Gold Project located in Ghana, Africa’s largest gold producer (1). The Project currently hosts an Indicated Mineral Resource of 743,500 ounces of gold at 0.55 g/t and an Inferred Mineral Resource of 972,000 ounces of gold at 0.65 g/t (2). Newcore Gold offers investors a unique combination of top-tier leadership, who are aligned with shareholders through their 20% equity ownership, and prime district scale exploration opportunities. Enchi’s 216 km2 land package covers 40 kilometres of Ghana’s prolific Bibiani Shear Zone, a gold belt which hosts several 5 million-ounce gold deposits, including the Chirano mine 50 kilometers to the north. Newcore’s vision is to build a responsive, creative and powerful gold enterprise that maximizes returns for shareholders.

On Behalf of the Board of Directors of Newcore Gold Ltd.

Luke Alexander

President, CEO & Director

For further information, please contact:

Mal Karwowska | Vice President, Corporate Development and Investor Relations

+1 604 484 4399

info@newcoregold.com

www.newcoregold.com

(1) Source: Production volumes for 2022 as sourced from the World Gold Council

(2) Notes for Mineral Resource Estimate:

- Canadian Institute of Mining Metallurgy and Petroleum ("CIM") definition standards were followed for the resource estimate.

- The 2023 resource models used ordinary kriging (OK) grade estimation within a three-dimensional block model with mineralized zones defined by wireframed solids and constrained by pits shell for Sewum, Boin and Nyam. Kwakyekrom and Tokosea used Inverse Distance squared (ID2).

- Open pit cut-off grades varied from 0.14 g/t to 0.25 g/t Au based on mining and processing costs as well as the recoveries in different weathered material.

- Heap leach cut-off grade varied from 0.14 g/t to 0.19 g/t in the pit shell and 1.50 g/t for underground based on mining costs, metallurgical recovery, milling costs and G&A costs.

- CIL cut off grade varied from 0.25 g/t to 0.27 g/t in a pit shell and 1.50 g/t for underground based on mining costs, metallurgical recovery, milling costs and G&A costs.

- A US$1,650/ounce gold price was used to determine the cut-off grade.

- Metallurgical recoveries have been applied to five individual deposits and in each case three material types (oxide, transition, and fresh rock).

- A density of 2.19 g/cm3 for oxide, 2.45 g/cm3 for transition, and 2.72 g/cm3 for fresh rock was applied.

- Optimization pit slope angles varied based on the rock types.

- Reasonable mining shapes constrain the mineral resource in close proximity to the pit shell.

- Mineral Resources that are not mineral reserves do not have economic viability. Numbers may not add due to rounding.

- The Mineral Resource Estimate is from the technical report titled "Mineral Resource Estimate for the Enchi Gold Project" with an effective date of January 25, 2023, which was prepared for Newcore by Todd McCracken, P. Geo, of BBA E&C Inc. and Simon Meadows Smith, P. Geo, of SEMS Exploration Services Ltd. in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects and is available under Newcore’s SEDAR profile at www.sedar.com. Todd McCracken and Simon Meadows Smith are independent qualified persons ("QP") as defined by National Instrument 43-101.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release includes statements that contain "forward-looking information" within the meaning of the applicable Canadian securities legislation ("forward-looking statements"). All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to: statements about the estimation of mineral resources; timing and completion of an updated PEA; results of metallurgical testwork, results of drilling, magnitude or quality of mineral deposits; anticipated advancement of mineral properties or programs; and future exploration prospects.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. The assumptions underlying the forward-looking statements are based on information currently available to Newcore. Although the forward-looking statements contained in this news release are based upon what management of Newcore believes, or believed at the time, to be reasonable assumptions, Newcore cannot assure its shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Forward-looking information also involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others: risks related to the speculative nature of the Company’s business; the Company’s formative stage of development; the Company’s financial position; possible variations in mineralization, grade or recovery rates; actual results of current exploration activities; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold and other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, unusual or unexpected geological formations); the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties.

Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information..

Subscribe

Subscribe