After-Tax NPV5% of US$212 million, After-Tax IRR of 42% at $1,650/oz Gold, Average Annual Gold Production of 104,000 ounces in years 2 through 5

Vancouver, BC – Newcore Gold Ltd. ("Newcore" or the "Company") (TSX-V: NCAU, OTCQX: NCAUF) is pleased to announce the positive results of an updated independent Preliminary Economic Assessment ("PEA") completed for the Company’s 100%-owned Enchi Gold Project ("Enchi" or the "Project") in Ghana. The PEA was prepared by BBA E&C Inc. ("BBA") in accordance with National Instrument 43-101 ("NI 43-101") and contemplates a technically simple, open pit mine and heap leach operation processing 6.6 million tonnes per annum ("mtpa") utilizing contract mining. The PEA also reflects an updated, pit constrained, Inferred Mineral Resource of 70.4 million tonnes ("Mt") grading 0.62 grams per tonne gold ("g/t Au") containing 1.4 million ounces gold. Only 20,195 metres of drilling from the ongoing 66,000 metre drill program was included in the updated Mineral Resource Estimate. All currencies are reported in U.S. dollars unless otherwise specified.

PEA Highlights

- Strong Project Economics with Low Capital Intensity

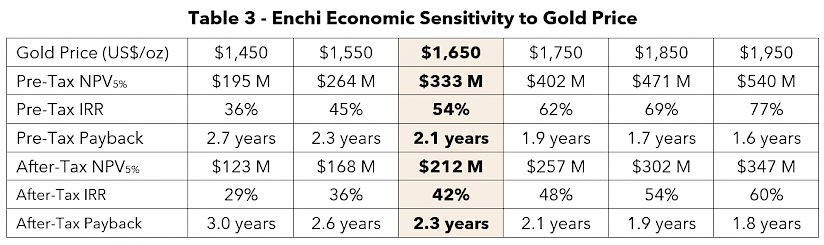

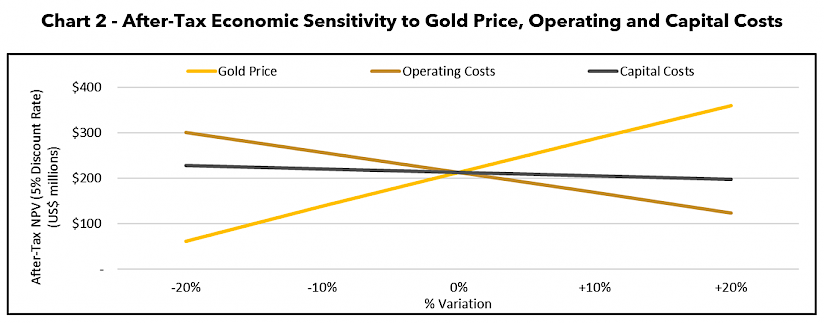

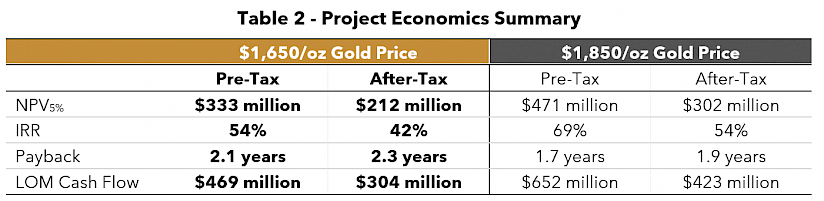

- At a gold price of $1,650/oz: $333 million pre-tax net present value discounted at 5% ("NPV5%") and a 54% pre-tax internal rate of return ("IRR"), $212 million after-tax NPV5%, and a 42% after-tax IRR.

- At a gold price of $1,850/oz: $471 million pre-tax NPV5% and a 69% pre-tax IRR, $302 million after-tax NPV5%, and a 54% after-tax IRR.

- Initial capital costs estimated at $97 million, with a short after-tax payback of 2.3 years.

- Establishing the Potential for a Robust Project with Significant Growth Potential

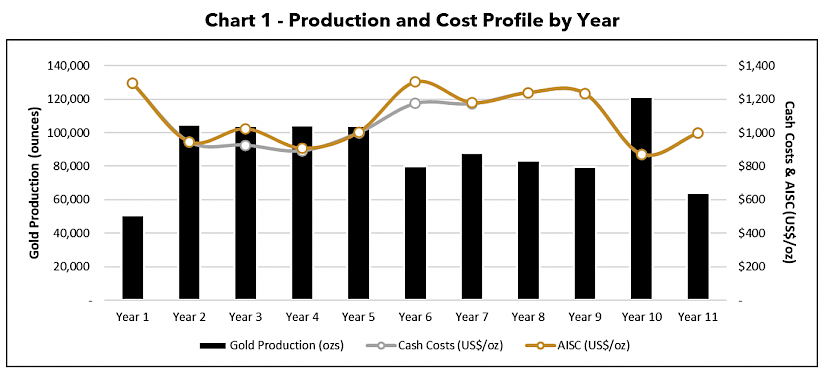

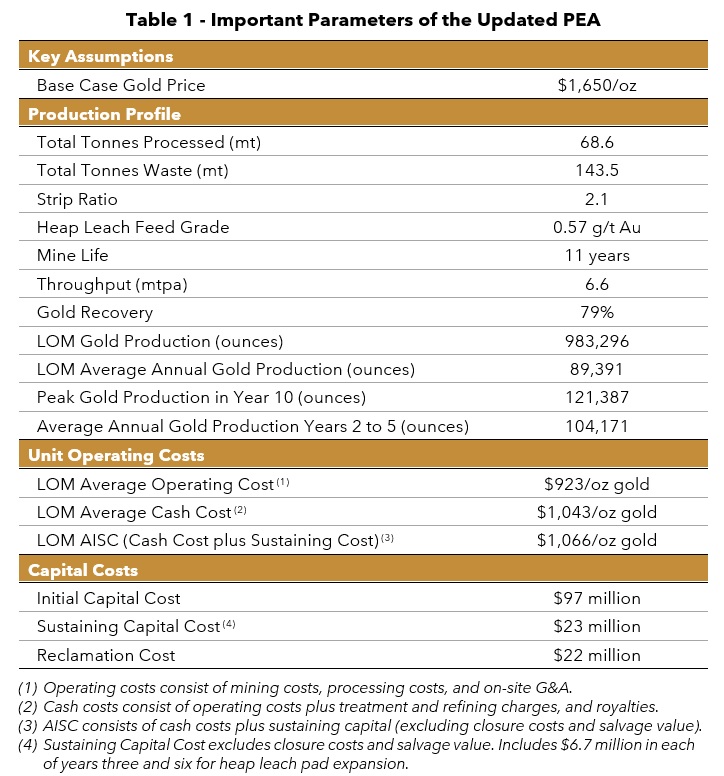

- Average annual gold production in years two through five of 104,171 ounces gold; 983,296 ounces gold recovered over an 11-year life of mine ("LOM").

- LOM strip ratio of 2.1 to 1, mined grade of 0.57 g/t gold and recovery of 79%.

- LOM operating costs (1) estimated at $923/oz of gold, cash costs (2) estimated at $1,043/oz of gold, LOM all-in sustaining costs (AISC) (3) estimated at $1,066/oz of gold.

- Updated Mineral Resource Estimate, Including an Initial Resource at Kwakyekrom

- The PEA includes an updated Inferred Mineral Resource Estimate of 70.4 Mt grading 0.62 g/t Au containing 1.4 million ounces gold.

- Incorporates 20,195 metres of drilling completed at Enchi in 2020 and early 2021.

- Additional Exploration Upside from Ongoing 66,000 Metre Drill Program at Enchi

- 46,000 metres of additional drilling was not included in the Mineral Resource Estimate.

- Exploration and drilling activities continue on the Enchi Gold Project, with drilling testing a series of highly prospective targets directed at extending the existing Mineral Resources along strike and down dip, further drilling of advanced gold targets across the 216 km2 property, and first pass testing of multi-kilometre scale gold anomalies.

- Recent drilling results not included in the PEA Mineral Resource Estimate have intersected wide zones of oxide gold mineralization as well as high-grade core structures including 5.40 g/t Au over 9.0 m, 5.78 g/t Au over 7.0 m, 6.25 g/t Au over 6.0 m, 3.31 g/t Au over 9.0 m, and 2.95 g/t Au over 9.0 m and remain open along strike and to depth.

Note: All currencies in this news release are reported in U.S. dollars unless otherwise specified. Base case parameters assume a gold price of $1,650/oz. NPV calculated as of the commencement of construction and excludes all pre-construction costs. Cash costs and AISC are non-GAAP financial measures (see cautionary language).

(1) Operating costs consist of mining costs, processing costs, and on-site G&A.

(2) Cash costs consist of operating costs plus treatment and refining charges, and royalties.

(3) AISC consists of cash costs plus sustaining capital (excluding closure costs and salvage value).

Luke Alexander, President and CEO of Newcore stated, "The updated PEA is a notable milestone for Newcore as we look to highlight the value of not only the exploration upside across the district scale property but also the economic value of the current resources that we have defined on the Project. The PEA results indicate that Enchi is an economically robust, low capital intensity, heap leach project with an after-tax NPV5% of $212 million and after-tax IRR of 42% at a gold price of $1,650 per ounce. Importantly, the economics also highlight the quick payback of capital, approximately 2 years after first gold pour. We believe that the Project and economics have a tremendous amount of upside from resource expansion both from shallow, near surface oxide mineralisation, but also from the higher-grade structures that we are starting to define at depth. This PEA only includes 20,195 metres of drilling from our ongoing 66,000 metre drill program, and only incorporates the shallow, open pit oxide material defined to date, with the first deeper drilling on the project underway to define the potential for resource growth at depth. We are excited to continue to define the district-scale, multi-million-ounce potential at Enchi and build off the underpinning of value that the updated PEA highlights."

Greg Smith, Vice President of Exploration of Newcore stated, "The PEA includes an updated Mineral Resource Estimate which has increased the pit constrained Inferred Mineral Resource to 70.4 Mt grading 0.62 g/t Au and containing 1.4 million ounces gold. The expansion was accomplished by extending the existing resources along strike and down dip, along with the inclusion of an initial resource estimate at Kwakyekrom which is interpreted to be an extension of the same structure hosting the Nyam Gold Deposit three kilometres to the north. All mineral resources remain open along strike and in all cases are defined by kilometre-scale gold-in-soil anomalies on surface and geophysical anomalies which characterize the structural trends. The inclusion of a shallow oxide resource at Kwakyekrom highlights the potential to discover additional deposits across the Project. We will continue to work towards defining the district scale potential of the Enchi Gold Project through our ongoing 66,000 metre drill program."

This updated PEA for the Enchi Gold Project was prepared by BBA, in accordance with NI 43-101 Standards of Disclosure for Mineral Projects, and a technical report for the PEA will be filed by Newcore on SEDAR within 45 days of this news release.

The PEA is preliminary in nature, includes Inferred mineral resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

PEA Overview and Financial Analysis

The Enchi Gold Project is located in southwest Ghana, with the Project’s 216 km2 land package covering approximately 40 kms of Ghana’s prolific Bibiani Shear Zone, a gold belt which hosts several multi-million-ounce gold deposits. Enchi is located 50 km to the south of Kinross’ Chirano gold mine which produced approximately 165,000 ounces of gold in 2020.

The updated PEA contemplates an open pit, heap leach operation with a low strip ratio using contract mining and processing 6.6 mtpa (approximately 18,000 tonnes per day). The heap leach facility will be built in three phases, with excess capacity available. Heap leach feed material will be trucked from four deposits (Sewum, Boin, Nyam, Kwakyekrom) to a central crushing and heap leach facility which will be located near Sewum, the largest currently defined deposit at Enchi.

The financial model was completed on a 100% project basis and includes a 5% gross royalty to the Ghanaian Government and a 2% net smelter return ("NSR") royalty to Maverix Metals Inc. The economic analysis carried out for the Project uses a cash flow model at a base price of $1,650 per ounce gold and a 5% discount rate. The financial assessment of the Project was carried out on a 100% equity basis, not accounting for potential sources of funding which may include debt. No provisions were made for the effects of inflation, and current Ghana tax regulations were applied to assess the tax liabilities. The Government of Ghana has the right to a 10% free carried interest in the Project.

The financial model was completed on a 100% project basis and includes a 5% gross royalty to the Ghanaian Government and a 2% net smelter return ("NSR") royalty to Maverix Metals Inc. The economic analysis carried out for the Project uses a cash flow model at a base price of $1,650 per ounce gold and a 5% discount rate. The financial assessment of the Project was carried out on a 100% equity basis, not accounting for potential sources of funding which may include debt. No provisions were made for the effects of inflation, and current Ghana tax regulations were applied to assess the tax liabilities. The Government of Ghana has the right to a 10% free carried interest in the Project.

A summary of the cash flow model can be viewed at the following link:

https://newcoregold.com/site/assets/files/5703/2021_06-ncau-pea-nr-summary-cash-flow-model-l.pdf

Mineral Processing and Metallurgical Testing

Mineral Processing and Metallurgical Testing

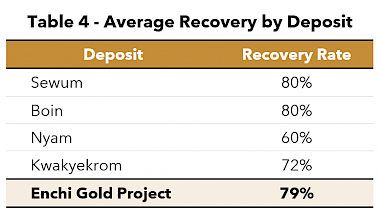

The updated PEA utilized an average gold recovery of 79%, with recoveries estimated for each deposit. These recoveries are based on preliminary metallurgical testwork completed to date on the Sewum, Boin, Nyam and Kwakyekrom deposits which consisted of a series of bottle roll and preliminary column tests completed on representative samples. This initial testwork showed that cyanide leaching is a viable option for the extraction of gold from the oxide, transition and fresh domains, and this recovery rate is consistent with typical heap leaching operations with a similar type of mineralization.

A conceptual heap leaching facility has been designed, with the facility processing oxide, transition and fresh rock mineralization.  Determination of the appropriate recovery value was based on preliminary test work carried out by Edgewater Exploration Ltd. and SGS in 2012 on samples from Sewum, Boin and Nyam, as well as additional metallurgical testwork completed by Newcore in 2020 and 2021, which included a series of bottle roll tests and four preliminary column tests by Intertek Minerals Limited, on samples from Sewum, Boin and Kwakyekrom.

Determination of the appropriate recovery value was based on preliminary test work carried out by Edgewater Exploration Ltd. and SGS in 2012 on samples from Sewum, Boin and Nyam, as well as additional metallurgical testwork completed by Newcore in 2020 and 2021, which included a series of bottle roll tests and four preliminary column tests by Intertek Minerals Limited, on samples from Sewum, Boin and Kwakyekrom.

Testwork completed in 2020 on the Sewum and Boin Gold Deposits consisted of a series of bottle roll tests on 49 representative oxide samples (29 from Sewum, 20 from Boin) from the ongoing 66,000 metre drill program. An average gold recovery of 89.4% was achieved from 24-hour bottle roll tests, with 43 of the 49 samples achieving a recovery greater than 75%. The samples from Sewum had an average recovery of 91.4% and the samples from Boin had an average recovery of 86.4%. Sewum and Boin are the two deposits on the Project that currently represent the majority of the Inferred Mineral Resource. Testwork completed in 2021 on the Kwakyekrom Gold Deposit consisted of a series of bottle roll tests on 25 representative oxide samples from the ongoing 66,000 metre drill program. An average gold recovery of 79.8% was achieved from 24-hour bottle roll tests, with 18 of the 25 samples achieving a recovery greater than 80% and averaging 86.9%.

Additional metallurgical test work is underway as part of the ongoing work program at Enchi, including column tests to better simulate heap leach conditions and further test for optimal crushing size, reagent consumption and leach permeability. Initial testwork supports cyanide leaching as a viable option for the extraction of gold from the three domains, but further work on the metallurgical behavior and physical constraint associated with heap leaching is still required to definitively select heap leaching as the best technical process option.

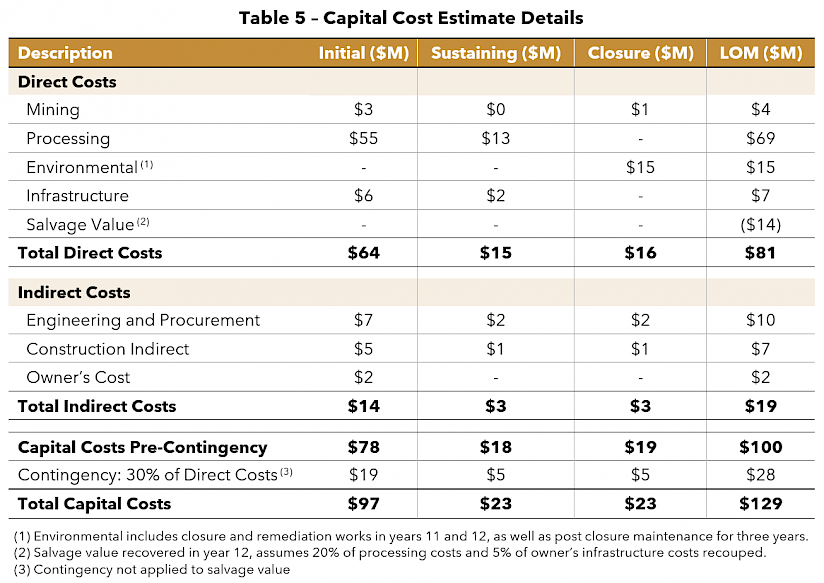

Capital Costs

An initial capital expenditure of $97 million (including 30% contingency on direct costs) has been estimated to construct the Project, with a further $23 million in sustaining capital during operations, $23 million for closure (including reclamation) and $14 million of salvage value. The capital cost estimate is based on an open pit mining and heap leach operation processing 6.6 mtpa utilizing contract mining. Capital costs are detailed in the table below.  This capital cost estimate is based on industry standard estimates. Capital cost estimates were developed using budgetary quotes provided by contractors experienced in Ghana, as well as updated estimates from the PEA completed on the Project in 2015.

This capital cost estimate is based on industry standard estimates. Capital cost estimates were developed using budgetary quotes provided by contractors experienced in Ghana, as well as updated estimates from the PEA completed on the Project in 2015.

Construction is estimated to be 15 months. The Enchi Gold Project benefits from relatively flat terrain (rolling hills) and simple infrastructure, limiting the amount of earthworks required. The initial capital costs reflect an estimate for the design and development of the plant and mine infrastructure that includes crushing, agglomeration, heap leaching, processing ponds and a gold recovery plant. The heap leach pads will be built in three phases, with a third of the cost upfront and the remainder included in sustaining capital in years three and six.

Reclamation and closure costs have been estimated based on the preliminary infrastructure plans and are inclusive of an allowance for rehabilitation monitoring and care and maintenance for three years post completion of mining.

Site Infrastructure

A proposed site plan for the Project can be viewed at the following link:

https://newcoregold.com/site/assets/files/5703/2021_06-ncau-enchi-pea-site-layout-l.pdf

The Enchi Gold Project is located in southwest Ghana, in the Aowin district of Western Region, and is accessed from Accra on sealed roads via the regional port city of Takoradi or the mining centre of Tarkwa. From either of these centres, access to the town of Enchi (population 11,737), the district capital, is available by paved and gravel roads. The town of Enchi is located 10 kilometres west of the Project. Fuel, accommodations, food and most supplies can be obtained in town. The region has a long history of mining, and there is a large population base of skilled and unskilled labour to draw upon for exploration and operations.

The Project area has limited to moderate infrastructure. A paved road crosses the central portion of the Project leading to the town of Enchi. The remainder of the Project is serviced by a series of gravel roads. As such, the majority of infrastructure works are anticipated to be greenfields. Ghana’s current electrical generation capacity of 2,125 megawatts is made up of about 50% hydro and 50% thermal plants. There is a 33 kV electrical line available near the Project, located approximately 10 kilometres from the proposed plant site, with prospective options for connection routes dependent on demand and capacity required. The electrical power supply, for the mining operations and heap leach facility, will be a combination of grid and diesel generated.

The anticipated infrastructure for the Project includes mine dry facilities, equipment maintenance workshop, refuelling facilities, explosive magazine, office administration facilities, assay laboratory, and warehouse facilities. As well as, access roads, stockpiling areas, storm water handling facilities, water supply, power supply network, diesel generators, sewage treatment plant, and waste management facilities. Given the Project’s proximity to the town of Enchi, it is assumed that no onsite accommodations will be required. Accommodations for expatriate and some senior staff may be provided through rental houses in the town of Enchi.

Modern seaports at Takoradi and Tema are located 207 km and 447 km southeast of the Project, respectively, and have been used for the implementation and construction of several gold mines in recent years.

The Enchi Gold Project currently totals 216 km2 with 40 kms covering the Bibiani Shear Zone, a well-known gold belt in Ghana that hosts multi-million ounce gold deposits. The Project is located 50 kms south of Kinross’ Chirano Mine.

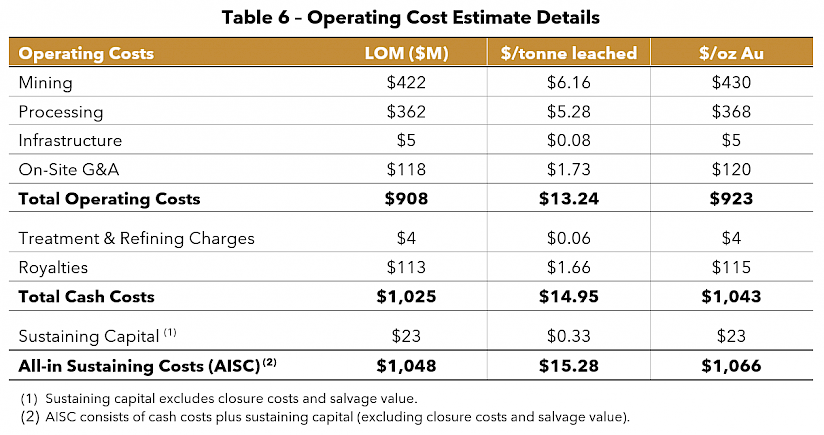

Operating Costs

The Project is modelled as a near surface, open pit, heap leach mine with heap leach feed material trucked from four deposits (Sewum, Boin, Nyam, Kwakyekrom) to a central crushing and heap leach facility which will be located near Sewum.

Operating costs for the life of mine are estimated at $908 million. Cash costs over that time are estimated at $1,025 million and include operating costs, royalties and refining charges. A 5% royalty on revenues is due to the Government of Ghana, and a 2% NSR royalty is due to Maverix Metals Inc. Camp costs for the Enchi Gold Project are lower relative to other projects because of the Project’s proximity to the town of Enchi where most administrative facilities can be located.

Operating costs are summarized in the table below. Mining Costs

Mining Costs

The PEA contemplates open pit mining undertaken by a contractor. An average unit mining cost of $1.99 per tonne of material mined was used for the financial analysis ($1.40/t mined for oxide, $2.10/t mined for transition, $2.60/t mined for fresh rock) which includes the transportation of mineralized material from the pits to heap leach facility. These costs have been determined based on local contractor budgetary quotations and experience from similar sized open pit heap leach operations and local conditions. The mining costs used in financial analysis consider variations in haulage profiles throughout the life of mine.

Processing Costs

An average processing cost of $5.28 per tonne of material leached was used in the economics, based on the designed process flowsheet. This includes crushing, agglomeration, heap leach operation, recovery plant, general site maintenance, and process labour.

Onfrastructure and On-Site G&A

Operating costs related to infrastructure includes gravel road maintenance, providing for annual replacement of the wear course layer of the site gravel roads.

On-site G&A includes costs related to on-site company personnel, management cost charged by the mining contractor, and mineral tenure fees. An annual total of $180,000 has also been allocated for corporate and social responsibility (~$2/oz of gold produced LOM).

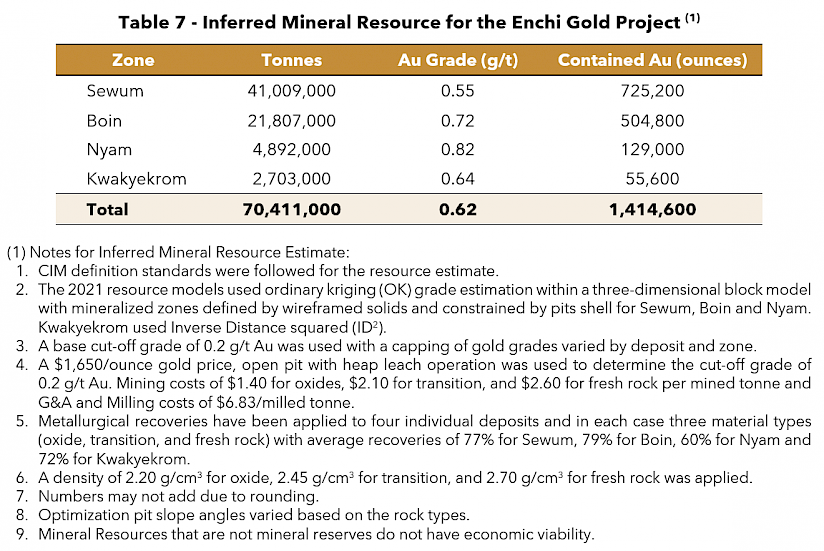

Mineral Resources

As part of the updated PEA, the Inferred Mineral Resource for the Project was updated to reflect additional drilling completed in 2020 and early 2021. The resource update includes 20,195 metres of RC drilling from the Company’s ongoing 66,000 metre drill program. The resource also reflects additional rock density work that was completed as part of the updated PEA, with a density of 2.20 g/cm3 for oxide, 2.45 g/cm3 for transition, and 2.70 g/cm3 for fresh rock applied. Previous mineral resource estimates used a density of 2.45 g/cm3 globally. The updated Mineral Resource Estimate was prepared by independent qualified person Todd McCracken, P. Geo. of BBA. The resource estimate is based on the combination of geological modeling, geostatistics and conventional block modeling using the Ordinary Krig methodology of grade interpolation for Sewum, Boin and Nyam. Kwakyekrom used Inverse Distanced squared. The mineral resources were estimated using a block model with parent blocks of 10m x 10m x 10m with sub-blocks to 2.5m x 2.5m x 2.5m. A capping study was made using histograms, probability plots, quantile plots and deciles plots to define the capping values resulting in variable capping values by deposit and zone.

The updated Mineral Resource Estimate was prepared by independent qualified person Todd McCracken, P. Geo. of BBA. The resource estimate is based on the combination of geological modeling, geostatistics and conventional block modeling using the Ordinary Krig methodology of grade interpolation for Sewum, Boin and Nyam. Kwakyekrom used Inverse Distanced squared. The mineral resources were estimated using a block model with parent blocks of 10m x 10m x 10m with sub-blocks to 2.5m x 2.5m x 2.5m. A capping study was made using histograms, probability plots, quantile plots and deciles plots to define the capping values resulting in variable capping values by deposit and zone.

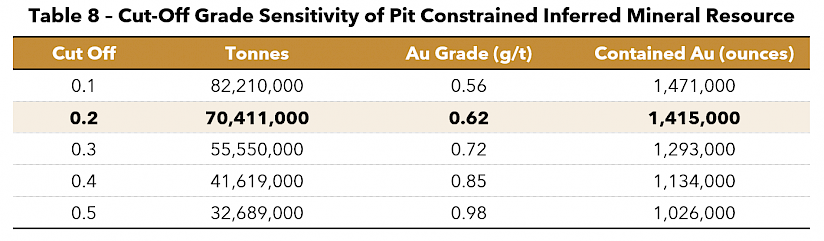

BBA also evaluated the pit constrained Inferred Mineral Resource Estimate for Enchi at a range of cut-off grades between 0.1 g/t Au and 0.5 g/t Au (Table 8 below).  The Mineral Resource Estimate for Enchi incorporates assay results from 182 diamond drill holes totaling 22,725 metres, 462 RC holes totaling 54,466 metres, 319 RAB holes totaling 12,424 metres and 187 trenches totaling 18,315 metres, variably spaced from 25 to 100 metres apart targeting the Sewum, Boin, Nyam and Kwakyekrom deposits. The data base comprises both historic and 2020 drill holes and trenches completed by Newcore.

The Mineral Resource Estimate for Enchi incorporates assay results from 182 diamond drill holes totaling 22,725 metres, 462 RC holes totaling 54,466 metres, 319 RAB holes totaling 12,424 metres and 187 trenches totaling 18,315 metres, variably spaced from 25 to 100 metres apart targeting the Sewum, Boin, Nyam and Kwakyekrom deposits. The data base comprises both historic and 2020 drill holes and trenches completed by Newcore.

The resource includes four deposits Sewum, Boin, Nyam and Kwakyekrom, each of which is open along strike and down dip. A number of additional exploration targets have also been identified outside of the existing resource area that present an opportunity for significant resource growth.

Mining and Production Schedule

A three-dimensional mining block model was created from the mineral resource block model for each deposit. The pit optimizations were conducted using the Deswik software, which runs the pseudoflow algorithm to determine the optimum pit shell.

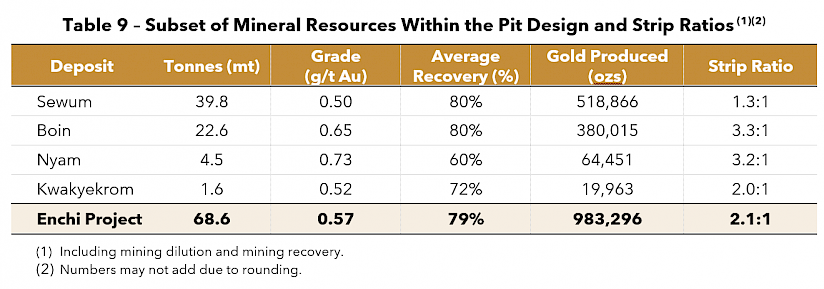

Mining would occur in a series of 10 open pits across the four deposits with depth ranging from approximately 20 to 180 metres. The open pits have been designed with 10 metre bench heights, inter ramp slope angles of 41 and 43 degrees for oxide and transition material and 54 degrees for fresh rock with ramp widths of 21 metres at a 10% maximum gradient. Table 9 presents the subset of mineral resources within the pit designs which was calculated based on cut-off grades ranging from 0.14 to 0.24 g/t gold. For Boin and Sewum, mining dilution was estimated at 4% with a grade of 0.07 g/t Au and a mining recovery of 97%. For Nyam and Kwakyekrom, mining dilution was estimated at 12% with a grade of 0.10 g/t Au and a mining recovery of 94%. The strip ratios by deposit are outlined in Table 9 below. The mine plan was prepared using Hexagon’s MinePlan Schedule Optimizer (MPSO) tool with the objective of maximizing NPV. The mine plan result in an 11-year mine life which delivers approximately 69 Mt of mineralized material with an average grade of 0.57 g/t Au to the process facility and approximately 143 Mt of waste rock to the storage facilities located near each pit. The maximum annual mining capacity reaches 22 mtpa between years five and eight. The LOM plan focuses on achieving consistent production rates, mining of the larger deposits (Sewum and Boin) early in the schedule which are located in closer proximity to the heap leach facility, and balancing grade and strip ratios. The mining operation is set at approximately 75% of the processing capacity to take into consideration a ramp up period in the first year. Since the mineralization is close to surface, very little pre-production waste stripping is required.

The mine plan was prepared using Hexagon’s MinePlan Schedule Optimizer (MPSO) tool with the objective of maximizing NPV. The mine plan result in an 11-year mine life which delivers approximately 69 Mt of mineralized material with an average grade of 0.57 g/t Au to the process facility and approximately 143 Mt of waste rock to the storage facilities located near each pit. The maximum annual mining capacity reaches 22 mtpa between years five and eight. The LOM plan focuses on achieving consistent production rates, mining of the larger deposits (Sewum and Boin) early in the schedule which are located in closer proximity to the heap leach facility, and balancing grade and strip ratios. The mining operation is set at approximately 75% of the processing capacity to take into consideration a ramp up period in the first year. Since the mineralization is close to surface, very little pre-production waste stripping is required.

Mining will be done using contract services under the supervision of Newcore and the PEA considers using a conventional truck and shovel operation. The mine production schedule is based on two 12-hour shifts, seven days a week for a total of 360 days per year.

A summary of the production schedule can be viewed at the following link:

https://newcoregold.com/site/assets/files/5703/2021_06-ncau-pea-nr-summary-production-profile-l.pdf

Enchi Gold Project Opportunities

A number of opportunities that may potentially improve the economics of the Enchi Gold Project have been identified, including:

- Expansion of the current open pits through further drilling at Sewum, Boin, Nyam and Kwakyekrom to define the potential for resource expansion both below and on strike from the current Inferred Mineral Resource.

- Incorporating drill results from an additional 46,000 metres of drilling that is not included in the updated Mineral Resource Estimate and is being completed as part of our ongoing 66,000 metre drill program.

- Additional metallurgical testwork to confirm and optimize gold recoveries, reagent consumption and flowsheet design.

- Potential to define further resource areas across the property at drill targets that do not currently have defined mineral resources but have prior drilling (Kojina Hill, Eradi).

- Follow-up on high priority airborne geophysical structural targets on the 216 km2 Project to define further potential targets across the property (Nkwanta, Tokosea, Sewum South).

- Deeper drill holes have begun to identify the potential to define higher grade gold mineralization at depth that may lead to the optimal processing methodology being a milling scenario designed for higher recoveries.

Drill Results Outside of PEA and Inferred Mineral Resource

A 66,000 metre discovery and resource expansion drilling program is underway at Enchi, with only 20,195 metres of the drill program incorporated into the updated PEA and updated Mineral Resource Estimate. The program includes both RC and diamond drilling and will include the first deep drilling planned on the Project. This drill program includes testing extensions of the existing resource areas while also testing a number of high priority exploration targets outside of the Inferred Mineral Resource. Drilling is focused on step out extensions and exploration drilling at the Sewum, Boin, Nyam and Kwakyekrom Deposits. Additional drilling is planned at previously drilled zones that are outside of the resource area (Kojina Hill and Eradi), along with first pass drilling to test a series of multi-kilometre-scale gold-in-soil anomalous zones with no prior drilling (Nkwanta, Sewum South and other anomalies). All zones represent high priority targets based on geological, geochemical and geophysical surface work and previous trenching and drilling.

Highlights from the ongoing drill program that are not incorporated in the PEA include:

Sewum Gold Deposit

Drilling has now expanded the drill tested strike extent at Sewum to 3.5 kilometres, with approximately 50% of the surface anomaly untested to date. The current pit constrained mineral resource at Sewum is defined across a strike extent of 2.4 kilometres. Key highlights:

- Drilling has intersected widespread gold mineralization with wider zones and higher grades associated with jogs in the controlling structure or with the intersections of multiple structures.

- Highlights from recent drilling, which highlights the potential to continue to expand the Sewum Deposit, include:

- Hole SWRC093 which intersected 0.60 g/t Au over 17.0 m from 32 m (oxide) and 0.82 g/t Au over 103.0 m from 61 m (sulphides) which was drilled on the edge of the current resource and open for expansion to the north.

- SWRC094 with 1.26 g/t Au over 16.0 m from 115 m and 2.35 g/t Au over 8.0 m from 175 m which is one of the deepest current intercepts at Sewum and highlights the potential to extend the resource to depth.

- Additional 3,663 metres of drilling has been completed as part of the ongoing drill program that will be included in a future update of the mineral resource estimate.

Boin Gold Deposit

Drilling has now expanded the drill tested strike extent at Boin to over four kilometres, with approximately 50% of the surface anomaly untested to date. The current pit constrained mineral resource at Boin is defined across a strike extent of three kilometres. Key highlights:

- Wide-spaced exploration drilling has extended gold mineralization both 400 metres to the north and one kilometre to the south of the current limits of the mineral resource open pits.

- Highlights from drilling outside of the resource area include:

- Hole KBRC236 intersected 0.90 g/t Au over 69.0 m from 55 m, including 2.06 g/t Au over 12.0 m from 61 m (mixed oxide and sulphide zone).

- Hole KBRC185 intersected 0.85 g/t Au over 67.0 m from 137 m, including 2.95 g/t Au over 9.0 m from 137 m (sulphide zone).

- Hole KBRC190 intersected 1.14 g/t Au over 36.0 m from 119 m, including 1.72 g/t Au over 18.0 m from 124 m (sulphide zone), as well as a second zone with 0.61 g/t Au over 8.0 m from 103 m (sulphide zone).

- Hole KBRC241 intersected 1.02 g/t Au over 36.0 m from 76 m, including 2.58 g/t Au over 7.0 m from 95 m (mixed oxide and sulphide zone), as well as an upper zone in the oxides grading 1.75 g/t Au over 9.0 m from 34 m.

- Hole KBRC225 intersected two gold mineralized zones returning 1.51 g/t Au over 2.0 m from 23 m (oxide zone) and 0.67 g/t Au over 39.0 m from 70 m (mixed oxide and sulphide zone), including 1.60 g/t Au over 8.0 m from 95 m (sulphide zone).

- Additional 8,340 metres of drilling in 60 holes has been completed as part of the ongoing drill program that will be included in a future update of the mineral resource estimate.

Nyam Gold Deposit

Drilling has now expanded the drill tested strike extent at Nyam to 1.8 kilometres, with approximately 40% of the surface anomaly untested to date. The current pit constrained mineral resource at Nyam is defined across a strike extent of 1.4 kilometres. Key highlights:

- The deepest intersections of mineralization to date have been drilled at Nyam, with mineralization now defined to a vertical depth of 200 metres. This drilling has intersected wide zones of gold mineralization containing higher grade core structures.

- Highlights from drilling outside of the resource area include:

- Hole NBRC045 intersected 1.57 g/t Au over 40.0 m from 179 m, including 5.40 g/t Au over 9.0 m from 185 m (sulphide zone).

- Hole NBRC047 intersected 1.94 g/t Au over 25.0 m from 222 m, including 5.78 g/t Au over 7.0 m from 227 m (sulphide zone).

- Hole NBRC024 intersected 1.34 g/t Au over 27.0 m from 57 m (sulphide zone), as well as a second zone with 3.45 g/t Au over 9.0 m from 93 m (sulphide zone).

- Hole NBRC044 intersected 1.17 g/t Au over 26.0 m from 41 m (oxide zone).

- Hole NBRC025 intersected 0.84 g/t Au over 32.0 m from 92 m (sulphide zone).

- Additional 5,235 metres of drilling has been completed as part of the ongoing drill program that will be included in a future update of the mineral resource estimate.

Kwakyekrom Gold Deposit

Drilling has now expanded the drill tested strike extent at Kwakyekrom to 1.3 kilometres, with approximately 40% of the surface anomaly untested to date. The current pit constrained mineral resource at Kwakyekrom is defined across a strike extent of 500 metres. Key highlights:

- Kwakyekrom is interpreted to be an extension of the Nyam structure and is located five kilometres south of the Nyam Deposit. The gold mineralization is open along strike and down dip with recent drilling extending the drill tested portion of the system by 500 metres to the south and providing the deepest intercepts to date.

- Highlights from drilling outside of the resource area include:

- Hole KKRC051 intersected 0.61 g/t Au over 50.0 m from 148 m, including 1.36 g/t Au over 9.0 m from 164 m (sulphide zone).

- Deepest intercepts to date on the central portion of the Kwakyekrom Deposit, with hole KKRC056 crossing the main structure approximately 150 metres vertically below surface intersecting an upper intercept of 0.96 g/t Au over 15.0 m from 110 m (sulphide zone), including 1.46 g/t Au over 9.0 m from 110 m, and a second interval of 0.94 g/t Au over 29.0 m from 160 m (sulphide zone), including 2.65 g/t Au over 6.0 m from 170 m.

- Hole KKRC055 intersected two gold mineralized zones, 1.21 g/t Au over 4.0 m from 8 m (oxide zone) and 0.94 g/t Au over 13.0 m from 108 m (sulphide zone).

- Hole KKRC065, the most southernly drilled hole to date and a 500-metre step-out to the south from prior drilling, intersected 0.90 g/t Au over 11.0 m from 94 m (sulphide zone).

- Additional 2,183 metres of drilling has been completed as part of the ongoing drill program that will be included in a future update of the mineral resource estimate.

Other Targets with No Defined Mineral Resource

- Kojina Hill is an advanced target on the property that is outlined on surface by a two-kilometre-long by one-kilometre-wide gold-in-soil anomaly. It is related to a structure sub-parallel to the Nyam Shear Zone and located 1.5 kilometres west of the Nyam Deposit. As part of the 2020 - 2021 drilling program, 14 holes totalling 2,588 metres have been completed. Kojina Hill does not currently have a mineral resource estimate and more drilling is planned targeting extensions to the gold mineralization.

- Eradi is one of the previously drilled target areas at Enchi where previous trenching returned 1.67 g/t Au over 36.9 m and 10 wide spaced shallow drill holes intersected gold mineralized intervals of 0.60 g/t Au over 27.0 m from 25 m, including 1.30 g/t Au over 10.0 m from 42 m, 1.15 g/t Au over 10.0 m from 58 m, 0.60 g/t Au over 17.0 m from 5 m, and 1.02 g/t Au over 10.0 m from 22 m. The zone has been tested at wide spacings over a strike length of 1.5 kilometres and remains open along strike and to depth.

- Sewum South is the largest gold-in-soil anomaly on the Project with a dimension of three kilometres by two kilometres and is located two kilometres south of the current Sewum Deposit. Mineralization is interpreted to be related to several sub-parallel and interesting structural trends defined by the geophysical signatures with similarities to the Sewum Deposit. A trenching program has been advanced as part of the 2020 - 2021 work program, with first drilling of this anomaly planned for later in 2021.

Plan maps and select cross sections for each deposit area can be viewed at the following link:

https://newcoregold.com/site/assets/files/5703/2021_06-ncau-nr-pea-enchi-maps-l.pdf

Presentation and Investor Webinar

Newcore will host an investor webinar to discuss the PEA on Thursday June 10, 2021 at 8am PDT / 11am EDT. Shareholders, analysts, investors and media are invited to join the live webcast by registering using the following link: https://my.6ix.com/CyNtxPeX.

After registering, you will receive a confirmation email containing details to access the webinar via conference call or webcast. The replay will also be available on Newcore’s website.

A presentation to accompany the webinar will be available on the Company’s website.

Qualified Persons and NI 43-101 Technical Report

The updated PEA for the Enchi Gold Project summarized in this news release was completed by BBA and will be incorporated in a technical report which will be available under the Company’s SEDAR profile at www.sedar.com, and on Newcore’s website, within 45 days of this news release. The compilation of the technical report was completed by Todd McCracken, P. Geo. (Mineral Resource and Financial Model), Bahareh Asi, P. Eng. (Mining), David Willock, P. Eng. (Infrastructure), Mathieu Belisle, P. Eng. (Processing). By virtue of their education, membership to a recognized professional association and relevant work experience, Todd McCracken, Bahareh Asi, David Willock, and Mathieu Belisle are independent Qualified Persons as this term is defined by NI 43-101.

COVID-19 Protocols

Newcore’s first priority is the health and safety of all employees, contractors, and local communities. The Company is following all Ghana guidelines and requirements related to COVID-19. The Company has implemented COVID-19 protocols for its ongoing drill program consisting of the mandatory use of personal protective equipment (including facemasks for all employees), maintaining social distancing, frequent hand washing, and daily temperature checks at the start of each shift.

Newcore Gold Best Practice

Newcore is committed to best practice standards for all exploration, sampling and drilling activities. Drilling was completed by an independent drilling firm using industry standard RC and Diamond Drill equipment. Analytical quality assurance and quality control procedures include the systematic insertion of blanks, standards and duplicates into the sample strings. Samples are placed in sealed bags and shipped directly to Intertek Labs located in Tarkwa, Ghana for 50 gram gold fire assay.

Qualified Person

Mr. Gregory Smith, P. Geo, Vice President of Exploration of Newcore, is a Qualified Person as defined by NI 43-101, and has reviewed and approved the technical data and information contained in this news release. Mr. Smith has verified the technical and scientific data disclosed herein and has conducted appropriate verification on the underlying data including confirmation of the drillhole data files against the original drillhole logs and assay certificates.

About Newcore Gold Ltd.

Newcore Gold is advancing its Enchi Gold project located in Ghana, Africa’s largest gold producer 1. The Project currently hosts an Inferred Mineral Resource of 1.4 million ounces of gold at 0.62 g/t. Newcore Gold offers investors a unique combination of top-tier leadership, who are aligned with shareholders through their 32% equity ownership, and prime district scale exploration opportunities. Enchi’s 216 km2 land package covers 40 kilometres of Ghana’s prolific Bibiani Shear Zone, a gold belt which hosts several 5 million-ounce gold deposits, including Kinross’ Chirano mine 50 kilometers to the north. Newcore’s vision is to build a responsive, creative and powerful gold enterprise that maximizes returns for shareholders.

(1) Source: Production volumes for 2019 as sourced from the World Gold Council.

About BBA

BBA has been providing a wide range of consulting engineering services for nearly 40 years. Engineering, environment and commissioning experts team up to quickly and accurately pinpoint the needs of industrial and institutional clients. Recognized for its innovative, sustainable and reliable solutions, the firm stands out for its expertise in the fields of mining and metals, energy, biofuels, and oil and gas. BBA has 14 offices across Canada to provide local support and offer clients onsite presence.

On Behalf of the Board of Directors of Newcore Gold Ltd.

Luke Alexander

President, CEO & Director

For further information, please contact:

Mal Karwowska | Vice President, Corporate Development and Investor Relations

+1 604 484 4399

info@newcoregold.com

www.newcoregold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements

This news release includes statements that contain "forward-looking information" within the meaning of the applicable Canadian securities legislation ("forward-looking statements"). All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussion with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always using phrases such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or variations (including negative variations) of such words and phrases, or state that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. In this news release, forward-looking statements relate, among other things, to: timing of completion of a technical report summarizing the results of the PEA; the development, operational and economic results of the PEA, including cash flows, capital expenditures, development costs, extraction rates, recovery rates, mining cost estimates; estimation of mineral resources; statements about the estimate of mineral resources; magnitude or quality of mineral deposits; anticipated advancement of the Enchi Gold Project mine plan; future operations; future exploration prospects; the completion and timing of future development studies; results of our ongoing drill campaign; anticipated advancement of mineral properties or programs; future exploration prospects; and the future growth potential of Enchi.

These forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business. The assumptions underlying the forward-looking statements are based on information currently available to Newcore. Although the forward-looking statements contained in this news release are based upon what management of Newcore believes, or believed at the time, to be reasonable assumptions, Newcore cannot assure its shareholders that actual results will be consistent with such forward-looking statements, as there may be other factors that cause results not to be as anticipated, estimated or intended. Forward-looking information also involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include, among others: risks related to interpretation of metallurgical characteristics of the mineralization, changes in project parameters as plans continue to be refined, future metal prices, availability of capital and financing on acceptable terms, uninsured risks, regulatory changes, delays or inability to receive required approvals, taxes, mining title, the speculative nature of the Company’s business; the Company’s formative stage of development; the Company’s financial position; possible variations in mineralization, grade or recovery rates; actual results of current exploration activities; fluctuations in general macroeconomic conditions; fluctuations in securities markets; fluctuations in spot and forward prices of gold and other commodities; fluctuations in currency markets (such as the Canadian dollar to United States dollar exchange rate); change in national and local government, legislation, taxation, controls, regulations and political or economic developments; risks and hazards associated with the business of mineral exploration, development and mining (including environmental hazards, unusual or unexpected geological formations); the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); and title to properties.

Forward-looking statements contained herein are made as of the date of this news release and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results, except as may be required by applicable securities laws. There can be no assurance that forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Non-GAAP Measures

This news release includes certain terms or performance measures commonly used in the mining industry that are not defined under International Financial Reporting Standards ("IFRS"), including cash costs and AISC per ounce of gold. Non-GAAP measures do not have any standardized meaning prescribed under IFRS and, therefore, they may not be comparable to similar measures employed by other companies. We believe that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate our performance. The data presented is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

Subscribe

Subscribe